- الصفحة الرئيسية

- المنتجات

-

-

اكتشف حلول تعدين العملات المشفرة المخصصة وذات العائد العالي لمختلف التطبيقات، المدعمة بخبرتنا والتزامنا بالدقة والموثوقية.

اكتشف أجهزة التعدين عالية الجودة لاستخدامات متنوعة، مدعومة بفهمنا العميق والتزامنا بالتميز.

-

- الأخبار

- اتصل بنا

- ربحية التعدين

- الدعم

AR

AR

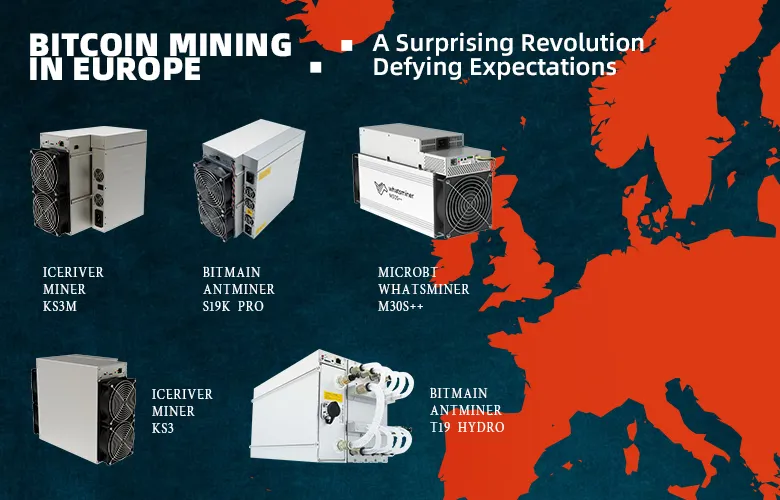

Bitcoin Mining in Europe: A Surprising Revolution Defying Expectations

Introduction

In the intricate tapestry of global Bitcoin mining, Europe emerges as a canvas of contrasts. From the icy fjords of the Nordic countries to the bustling urban centers of Germany and France, the continent’s relationship with the world’s premier cryptocurrency is both complex and evolving. While the Nordic regions have long been the bastion of European Bitcoin mining, thanks to their favorable electricity prices, the broader European landscape has been somewhat reticent. But why?

The answer, in part, lies in the cost of electricity. Bitcoin mining, as any enthusiast would attest, is an energy-intensive endeavor. The high electricity costs in many European nations have historically rendered large-scale mining operations economically unviable. But as with many things in the world of decentralized finance, change is the only constant.

Enter renewable energy

Europe stands at the precipice of an energy revolution. A shift is underway, one that’s steering the continent away from traditional energy sources and towards the boundless potential of wind, solar, and hydroelectric power. This isn’t just about reducing carbon footprints or meeting international environmental agreements; it’s about reshaping the very fabric of Europe’s economic and technological future.

For Bitcoin miners, this transition to renewable energy opens up a realm of possibilities. Imagine harnessing the power of the midsummer sun in Spain or the relentless winds of the Scottish highlands to fuel mining rigs. The dream of sustainable, profitable mining in Europe is no longer a distant mirage; it’s a tangible reality waiting to be grasped.

As we delve deeper into this exploration, remember the words of the ancient Greek philosopher, Heraclitus: “The only thing that is constant is change.” In the dynamic world of Bitcoin and blockchain, Europe’s renewable energy transition might just be the change that redefines the continent’s mining landscape.

The Evolving Terrain of Bitcoin Mining in Europe

Europe, with its rich historical tapestry and technological advancements, stands at a unique crossroads in the Bitcoin mining narrative. The North, characterized by the Nordic nations, has emerged as a beacon for miners worldwide. What draws them to these chilly terrains? A harmonious blend of nature’s cold embrace, reducing the need for artificial cooling, and an abundant supply of green energy. This eco-friendly synergy doesn’t just promise cost-effectiveness; it resonates deeply with the sustainable aspirations of the modern crypto enthusiast.

However, as we traverse further south, the story takes a different hue. Technological powerhouses like Germany, France, and the Netherlands, despite their pioneering spirit in blockchain innovations, are ensnared by the high costs of electricity. In the world of Bitcoin mining, where energy consumption is paramount, these escalating costs can be the line between profit and loss. It’s a quandary that forces miners to make a choice: mine fueled by sheer passion and belief in the decentralized dream or seek more economically viable terrains.

This very juxtaposition was the focal point at BTC Prague’s enlightening panel discussion. A confluence of thought leaders, including the likes of Bob Burnett, Adam Back, and Fabian Weber, delved deep into the intricacies of European mining. This wasn’t merely a conversation; it was a testament to the community’s shared vision and the future trajectory of Bitcoin mining on the continent.

In this unfolding saga, one truth is evident: Europe, with its diverse amalgamation of cultures and technological prowess, remains a pivotal player in the Bitcoin odyssey. While challenges persist, they are mere catalysts, ushering in innovative solutions that will redefine the contours of cryptocurrency mining and global finance.

The Role of Renewable Energy in European Bitcoin Mining

Europe, with its rich history and forward-thinking ethos, is undergoing an energy metamorphosis. The continent’s skyline, once dominated by industrial silhouettes, now gleams with the rotating blades of wind turbines and the reflective sheen of solar panels. This isn’t just an aesthetic transformation; it’s a testament to Europe’s steadfast commitment to a sustainable future.

The Dual-Faceted Challenge of Fluctuating Prices

Electricity prices in Europe, especially with the integration of renewables, are akin to a pendulum—constantly swinging. For Bitcoin miners, this oscillation can be both a boon and a bane. The unpredictability poses a challenge in forecasting operational costs, yet the lows offer a lucrative window for maximized profitability.

To understand the potential interplay between renewables and Bitcoin mining, one must cast their gaze towards Texas. The vast American state, blessed with abundant sun and wind, has become a beacon for Bitcoin miners. The Texan model showcases how to adeptly navigate the ebb and flow of renewable energy, optimizing mining operations to coincide with energy surpluses.

As Europe continues its green energy march, the Bitcoin mining sector stands on the cusp of a revolution. By embracing the lessons from Texas and adapting to the continent’s unique energy landscape, European miners can not only ensure profitability but also champion a sustainable approach to cryptocurrency mining.

Mining Equipment Suitable for Europe

Pioneering the Future: CryptohashMiners’s Role in European Bitcoin Mining

In the intricate world of Bitcoin mining, the tools of the trade are as crucial as the trade itself. As Europe stands on the precipice of a mining renaissance, powered by its shift towards renewable energy, the choice of mining equipment becomes paramount. Enter CryptohashMiners, a beacon in the vast sea of mining equipment suppliers.

CryptohashMiners isn’t just another name in the industry; it’s a vanguard. With a reputation for supplying top-tier mining equipment, it has become synonymous with reliability and innovation. For miners in Europe, looking to harness the continent’s renewable energy potential, CryptohashMiners offers a curated selection of machines that promise efficiency, power, and sustainability.

Let’s delve into some of the standout models:

ICERIVER KAS Miner KS3M: A powerhouse in its own right, the KS3M is known for its efficiency and robust performance. Designed for the discerning miner, it promises optimal hash rates without compromising on energy consumption.

Bitmain Antminer S19k Pro: A stalwart from the Bitmain lineage, the S19k Pro is revered for its balance between power and energy efficiency. Its advanced architecture ensures that miners get the most out of every watt consumed.

MicroBT Whatsminer M30S++: A testament to MicroBT’s commitment to innovation, the M30S++ boasts impressive hash rates. Its design prioritizes both performance and longevity, ensuring that miners get a reliable companion for their operations.

ICERIVER KAS Miner KS3: A sibling to the KS3M, the KS3 offers a blend of performance and affordability. It’s an ideal choice for miners who are looking to scale their operations without breaking the bank.

Bitmain Antminer T19 Hydro: Diverging from the traditional, the T19 Hydro introduces liquid cooling, ensuring optimal temperatures even during intensive mining sessions. It’s a nod to the future, where efficiency and sustainability go hand in hand.

In the context of European mining, these models offer a distinct advantage. As the continent grapples with fluctuating electricity prices, the efficiency of these machines ensures that miners can maximize their profits during low-cost windows. Moreover, their compatibility with renewable energy sources means that miners can truly align their operations with Europe’s green vision.

In essence, as Europe carves its niche in the global Bitcoin mining narrative, CryptohashMiners stands as a trusted ally, offering tools that are not just state-of-the-art but also in harmony with the continent’s ethos.

Challenges and Opportunities Ahead

Navigating the Electric Labyrinth: The Dual Faces of Europe’s Power Pricing

In the intricate dance of Bitcoin mining, electricity plays the tune. The cost of power, often fluctuating and unpredictable, dictates the rhythm and pace of mining operations. As Europe stands at the crossroads of its renewable energy journey, miners on this continent face a unique set of challenges and opportunities, shaped by the very essence of electricity pricing.

The viability of Bitcoin mining is, at its core, a mathematical equation. The cost of electricity on one side, and the potential rewards of mining on the other. For this equation to tilt in favor of profitability, miners need extended hours where electricity prices dip below the breakeven point. In the current European landscape, these hours are sporadic, making the mining endeavor a game of precision and timing. Miners must be astute, ready to harness those fleeting moments when the scales of profitability tip in their favor.

Yet, amidst these challenges, Europe presents a silver lining. Countries like the Netherlands and Germany, with their advanced infrastructures and technological prowess, are emerging as potential hubs for industrial-scale mining facilities. These nations offer a blend of robust connectivity, regulatory clarity, and a thriving crypto ecosystem. The potential to set up large mining farms, powered by renewable energy and optimized for efficiency, could redefine Europe’s stance in the global mining narrative.

But there’s another phenomenon that’s silently reshaping the mining landscape: negatively-priced hours. As Europe aggressively integrates renewable sources into its energy grid, there are intervals when the supply of electricity outstrips demand. During these windows, prices plummet, often venturing into the negative territory. For the uninitiated, this might seem like an anomaly, but for the astute miner, it’s a golden opportunity. Negatively-priced hours, though sporadic, offer unparalleled profitability, turning challenges into lucrative prospects.

In conclusion, as the winds of change sweep across Europe, the continent’s miners find themselves in a dynamic play of challenges and opportunities. With the right strategies, tools, and a keen understanding of the electric labyrinth, they can not only navigate the hurdles but also usher in a new era of sustainable and profitable mining.

Conclusion

As the curtain falls on our exploration of Bitcoin mining in Europe, a vivid tapestry of potential and promise emerges. The continent, with its rich history and forward-looking ethos, stands on the brink of a crypto renaissance, powered by the inexorable march of renewable energy.

The bullish scenario for Bitcoin mining in Europe is not a mere projection; it’s a tangible reality taking shape. The aggressive integration of wind, solar, and hydroelectric power into the continent’s energy matrix is more than an environmental pledge—it’s a clarion call to miners. Europe offers not just the promise of sustainable mining but also the allure of profitability, especially during those golden hours when renewable surpluses drive electricity prices below the breakeven point.

Yet, miners in this evolving landscape are not mere participants; they are pivotal players. By aligning their operations with the ebb and flow of the electricity grid, they provide much-needed flexibility. They stand as buffers during periods of energy surplus, consuming power that might otherwise go to waste, and in doing so, they play a crucial role in maintaining the grid’s equilibrium.

Looking ahead, the future of Bitcoin mining in Europe is a mosaic of challenges and opportunities. Factors like fluctuating electricity prices, evolving regulations, and rapid technological advancements will shape this narrative. But if history is any indication, Europe, with its indomitable spirit of innovation, will navigate these waters with finesse and vision.

In essence, as the winds of change blow across the European landscapes, from the icy Nordic fjords to the sun-kissed Mediterranean shores, the dream of a sustainable, profitable, and vibrant Bitcoin mining ecosystem is not just alive—it’s thriving.

أسئلة مكررة

1.Why is Bitcoin mining currently infeasible in many European countries?

Bitcoin mining, particularly in countries like Germany, the Netherlands, France, and the UK, has been challenged by elevated electricity prices. These prices, especially since the energy crisis of late 2021, have made it difficult for mining to be profitable in these regions.

2.How can renewable energy sources impact Bitcoin mining in Europe?

Europe’s aggressive expansion into wind and solar energy could lead to periods of surplus electricity production. During these times, electricity prices can drop significantly, even going negative. Such scenarios offer Bitcoin miners the opportunity to operate at reduced costs, making mining more viable.

3.What lessons can European miners learn from Texas?

Texas has seen a surge in Bitcoin mining due to its surplus wind and solar energy. Miners in Texas have learned to optimize their operations based on the availability of renewable energy, running their machines during periods of surplus and turning them off during deficits. This model can be emulated by European miners to maximize profitability.

4.Are there any potential locations in Europe for industrial-scale mining facilities?

With the increasing prevalence of negatively-priced electricity hours, countries like the Netherlands and Germany could emerge as potential hubs for industrial mining facilities, provided the prevalence of low-cost electricity hours increases and mining equipment becomes more affordable.

Bitcoin

Bitcoin  Ethereum

Ethereum  Dogecoin

Dogecoin  Zcash

Zcash  Litecoin

Litecoin  Ethereum Classic

Ethereum Classic  Dash

Dash  Alephium

Alephium